20: An Interview with Kelly Mathis About How to Create a Profit First System for Your Creative Business (The Systems & Workflow Magic Podcast)

Welcome to another episode of The Systems and Workflow Magic Podcast! Today, we are chatting about the profit first method with financial educator Kelly Mathis. This is something I struggled with for years in my business, but through working with Kelly I have been able to sort out my own financial workflow and systems that are helping my business to thrive!

The Systems and Workflow Magic Podcast is brought to you by Dolly DeLong Education. This is a podcast for creative business owners who want to learn tangible steps to automate their business through workflows, systems, tools, and strategy in order to go from scattered to streamlined with purpose. Because even muggles can become automated wizards.

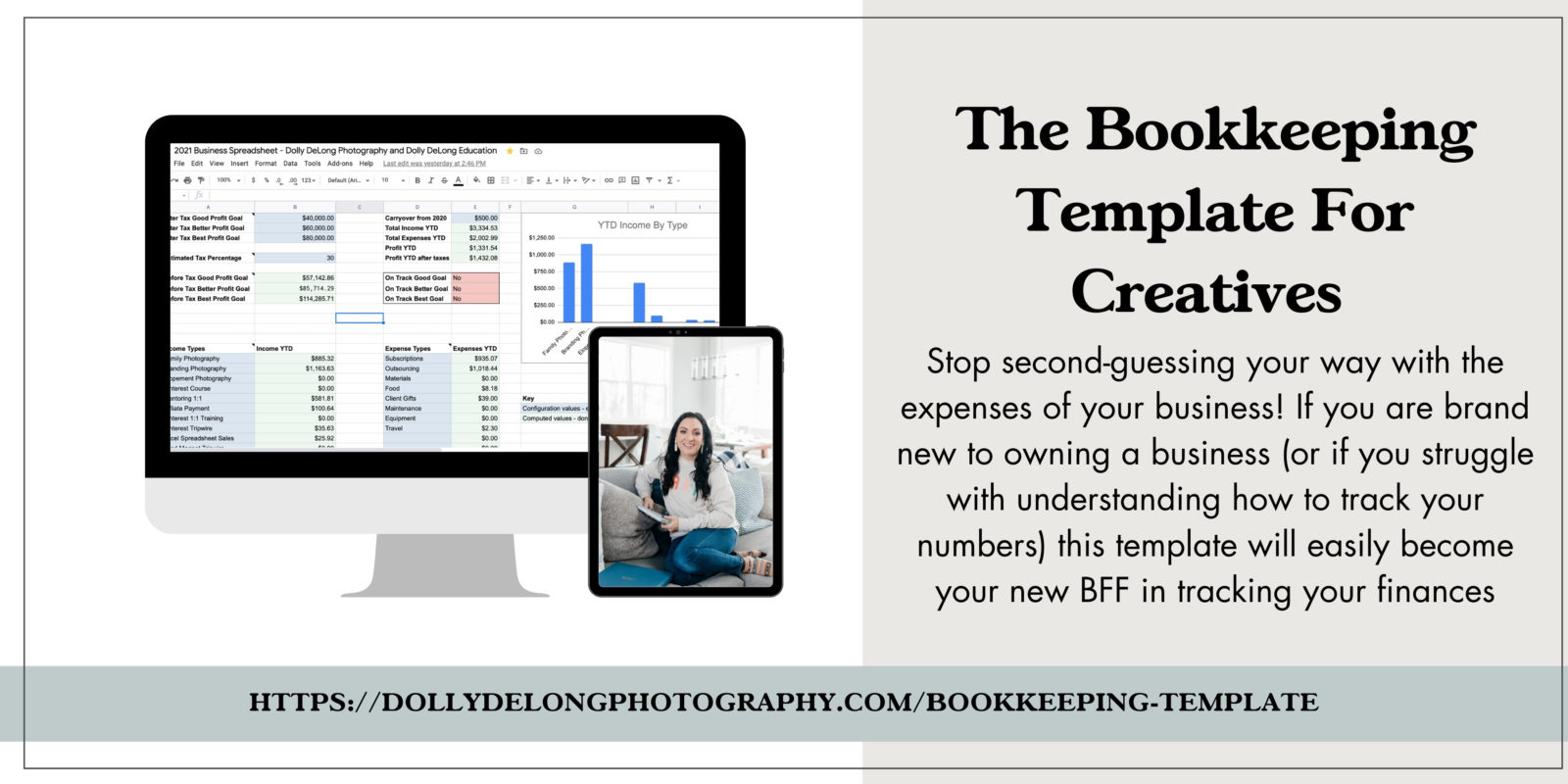

Bookkeeping Template for Creatives

Most entrepreneurs struggle in one area of their business—finances. You can create systems around your money too! This will help you keep track of your finances, plan for tax season, monitor expenses, and prioritize your money! I’ve created an easy to use spreadsheet for you to use to track your bookkeeping! Use the code PODCAST for 20 off!

Review the Show Notes:

Get To Know Kelly Mathis (1:43)

What exactly is profit first? (3:51)

Where did Kelly learn profit first? (7:25)

Why is a profit first method essential for business owners? (12:22)

Tangible steps a creative business owner can take towards profit first (14:36)

Kelly’s daily, bi-weekly, and quarterly systems and workflows for profit first (20:45)

Connect with Kelly ⬇️

kellygracephoto.com/profit-first-training-landing-page

Connect with Dolly ⬇️

instagram.com/dollydelongeducation

facebook.com/DollyDeLongEducation

Review the Transcript:

Dolly DeLong

Welcome to the systems and workflow magic podcast where I help entrepreneurs go from scattered to streamlined in their creative businesses. I’m your host, Dolly DeLong, a wife, a mom, and a photographer turned systems educator. Join me every week as we have conversations centered around creating tactical workflows, and automation for your business. Now, let’s make some strategic workflow magic. All right. Hey, everyone, and welcome back to the systems of workflow magic podcast. This week, we are going to be chatting about finances and profiting first within your small business. And this is something that is near and dear to my own heart. And because this is something I struggled with, for years, in my own small business, even though I was making money, I wasn’t really. And so in came my profit. Who is here today, and she’s going to be sharing, just like tangible ways that others can start reading systems for themselves in profiting first even starting from day one or your 10th year of owning your business like this is a really important discussion. Also, people are probably freaking out about having to gather data for their taxes and papers or whatever you want to call it and wanting to hopefully, help you pass division four for yourself for future planning for next year’s taxes or even for this year’s quarterly tax. What steps you can be taken for profit first. So welcome, Kelly, Do you mind introducing yourself to everyone?

Kelly Mathis

Yeah, we’d love to first for all, thank you for having me on here. And so excited to talk with you today about profit first. So I am Kelly and I’m a hybrid photographer, specializing in Midwest weddings, destination weddings, and senior portraits. When I’m not documenting beautiful weddings, I’m a financial educator to creative entrepreneurs, basically coaching them on how to pay off debt, create a savings plan, and build a sustainable and profitable business. My goal is really to teach others how to live out their creative dreams while experiencing more freedom, less stress, life-changing wealth, and really a lasting legacy for generations to come. I’m also a mama to five sweet kiddos. And I am also a wife of eight years to my carpenter husband, Ben. So a little bit about me.

Dolly DeLong

Oh, and your family is so beautiful. You should know that.

Kelly Mathis

Oh, thank you. They’re a handful.

Dolly DeLong

Those of you who don’t know Kelly and I were in a mastermind together last year, and Kelly brought her youngest daughter who was under a year to our mastermind like our final retreat. And I bet as a mom like if I had brought my son I would probably be flustered. But I loved having your daughter there like she was just a sweet retreat. Anyways, nobody does this, like nobody’s gonna see it. But like we had like pizzas or night and the bigger than her doctors, but like, that’s how big Oh, that’s something that I will

Kelly Mathis

be huge. Yeah, she was what I think three months, three months all at the time. And so that was just such a funny memory. Well, to get that picture out there.

Dolly DeLong

Yeah, seriously, she was. It was fun having the baby there and just like seeing you like still being present for your business. And then at the same time, like pouring into your daughter. I’m like, she’s creating a good like, legacy for her daughter right here. So anyways, it was really Yes, yes. Oh, but let’s set the stage like with what exactly is profit first? What does that mean?

Kelly Mathis

Yes, yes. Such a good question. So Profit First is a book written by Mike Michalowicz. I don’t know if that’s how you pronounce his name, but I think that’s what it is. But if you’ve not read it, I highly, highly recommend reading it as he shares so much good information in that book, and more than what I can discuss today. But he really breaks it down really, really well. And he also shares other stories from other entrepreneurs who have also implemented this method into their business and how it has worked out so well for them. So definitely read the book. But really, the core of the book is based on one simple formula inside accounting, and simply just switching it around. So most businesses calculate profit as revenue minus expenses equals profit. And so when I talk about revenue, I really mean like all the income you have coming into your business from all different sources. So whether that be like wedding photography, branding, photos, coaching, given online shop, like those different types of things would be considered like your revenue. So essentially, you Take all of your revenue, and you subtract out all, you subtract out the amount it takes to run your business. So all your expenses, and whatever is leftover is considered your profit. So while it makes sense to cover expenses, first, there really is no guarantee that you’ll make a profit using that formula. You could overspend some months if you’re not taking if you’re not keeping track of expenses. So it’s just, it’s really not a good way to do it. So basically, the profit first formula flips any equation giving profit, the focus it deserves. So it’s revenue minus profit equals expenses. So basically, it says, here’s all our revenue, this is all the income we have coming in. And let’s take out the Profit First, hence the name of the method. And then these expenses that are left over is what we have to run our business on. So if we can’t run our business and what is left over, then something’s wrong, something needs to be tweaked. Or you really just need to sit down and look to see where you can cut expenses, you can survive on that amount. So when you finally get this method set up, this is going to be the outcome. So I’ll kind of break it down later. But this is what the outcome will be. So you’ll have a bank account, one with five accounts. And so those five accounts are an income account, that’s all your money would go into, you’d have a profit account, you’d have a taxes account, where you pay your taxes from, you’d have an owner’s compensation account, which is where you would pay yourself from like pay your salary out of, and then you have an operating expense account, which where all your expenses are paid out of. And then you would also have a second bank, and at the second bank, you’d have a profit account and a tax account. Again, I’ll break this down a little bit later. Let’s kind of the gist of that part of it. And then the other two things we’ll need to know which again, we’ll talk about in a little bit is what you call a target allocation percentage, or a tap, which is a tip. And then you’ll also need to know a current allocation percentage, or C AP cap. So basically, all the money that you get in all your revenue like I talked about is going to come into that income account and be dispersed into these other four accounts based on these allocation percentages. Again, I’ll talk a little bit about those a little bit later. But I just want you to know, once you have everything in place, once you have this method set up the really the outcome will be you’ll have seven accounts, you have two different banks, and you’ll have a target allocation percentage setup, and a current allocation percentage setup. So I know that sounds like a lot, but we’ll kind of dive deep more into that in just a little bit.

Dolly DeLong

Yeah. Can I like backtrack a little bit and ask you where you started learning profit? Because I know you initially main focus is fine art wedding photography. But what got you started with profit first? Yeah.

Kelly Mathis

So it was actually quite a few years ago, I saw many other photographers and creative business owners sharing about the book Profit First through social media and became member exactly what was but it was like two or three people I kept seeing talking about it. And so one of the things that really I struggled with when I started my business was what to do with the revenue I received in my bank account. At the time, I only had one business account, because that’s what I thought I only needed was just that one account. And I really had no idea how to pay myself how to pay for taxes or other expenses, I always seem to use up all the money that was my in my account. And I really had nothing to show for it. So all the money that came in, went out because of that this book really really piqued my interest. So I went ahead, I purchased the book, I devoured the information, I set up the system in my business, and immediately just fell in love with that whole process of it, it was so easy to implement, like it just a lot of what he talks about. It’s just a lot of common sense. It just made sense to set it up in my business. So I knew if I was struggling with business finances that other people had to be too and so it just really made me interested in kind of helping other photographers and creatives get this set up in their business as well.

Dolly DeLong

Oh, I’m so grateful for like that you pave the way for who you like, I know other people paved the way before you but I’m just saying like it clicked for you. It was able to click for me. As a creative business owner, I needed another creative business owner to walk me through the tangible steps. And I’d love numbers. I love data. But then there are moments where I’m like, I need somebody to dumb it down for me even more so that I could like apply it to my and so I guess

Kelly Mathis

a lot of people find finances to be super unsexy. Yeah, which I get so but it’s a key thing that you need to have a good understanding about. So yes,

Dolly DeLong

yes, I will say to everyone who’s listening we you had shared like you were making so much money, then you have nothing to show for it. At the end of the month. Yep. And that is exactly how I was like, Sir, I don’t even know how my business was surviving. But that is how I was doing it for the longest time. Like my husband even told me like you’re making so much money, but yet it’s not like showing anything At the end of the month, like what is happening, and there was like, friction and tension, like in the household, and he had every right because like, he’s my spouse and like, we’re like a combining. And so you came at the perfect time, Kelly cuz I was like, Yeah, something like, because I like, I’m so proud of my business like what it’s become in the last X amount of years. And so sitting with you and like having you lift the script for me, like looking at profit, and not like subtracting overhead expenses, that has been so helpful. And just, even the first month, I made like a huge profit. And my husband was like, yep, what’s, what are you doing differently? I was like, and he, I know, I know, I share this with you so much, like, I text you this, but I’m like, my husband is thankful for you. Not that, like he was like, You need to make money. But he’s like, it’s nice. Like to have a profit. Like we have it. I have my business brings in and consistent profit every month. And it’s like, we work together. And, and I’m still like, I know all the numbers of my business, which is, yeah. Oh, cool. So anyway, I just have to say, my loves you. It’s like the light light bulb went off for you. Yeah, the light bulb went off for you. And that’s exactly what I wanted. So I’m super glad that it helped. The other thing, too, that I’ll mention is, if you have, say, if you base it off your expenses, that’s all you have left to use, you’ll kind of become more frugal. Like, you’ll cut expenses, if that’s all the amount that you have, you’ll go through, you’ll figure out what you can cut to kind of become more innovative, and you use all sorts of different ways to just use that money in what you have. Like, that’s all you have. So yeah, that’s another big part of it, too. Yeah, that’s so true. Because I was like, you see, all this money is coming in. And you’re like, oh, I need to spend it.

Kelly Mathis

I love I love ya

Dolly DeLong

have like a good system in place. And I know my husband like, again, everybody’s for like her husband sounds mean, I love that. He’s awesome. Like, he’s the reason why we’re debt free. And like, I needed guardrail. So it was it was really good for me for my

Kelly Mathis

good. I’m so glad to hear that. So I

Dolly DeLong

kind of guessed this, like leads into the next question. Why do you think it’s essential for creative business, like business owners in general, to do a profit first month? Yeah, set up a system for themselves?

Kelly Mathis

Sure. So I was doing a little bit of research a couple months ago for a talk. And I found that so According to various sources, eight out of 10 businesses don’t make it five years. So I found that like in various different areas where eight out of 10 businesses don’t make it, which was just crazy to me. And really, the reason why most of them closed is they don’t really have a good grasp on their finances. Either they didn’t have a proper cash flow, so didn’t have enough money coming in to cover their expenses, they didn’t plan or save for taxes or equipment, or they just had like a core pricing model. So they weren’t charging enough. So it could be various, you know, a bunch of different of those. But as a small business owner, we know you know, it’s really scary running our own business, you know, income is all over the place, someone’s will make more other ones, Nicholas, expenses are really sporadic. And we just we wake up knowing every day that we need to make something happen in order to keep the lights on. So it’s kind of scary as a small business owner. So really, it’s important to have a process or workflow in order to have a really good handle on our finances. So we need to know how much revenue we have coming in where that money is going each month, what we’re spending our expenses on, and just really have a good understanding of the health of our business. That way we can make good financial decisions going forward, and then really not be one of those eight businesses that close, you know, within five years. So yeah, you just really need to have a good basis, a good knowledge of where your finances are each month. Totally agree.

Dolly DeLong

And I just want to point out like, Kelly is not being paid by the Profit First, like author to say all this. I know, this is very true. Like every business owner needs to have a healthy financial foundation. Um, in order to run the show. This is something that a lot of business owners also, like you’re saying, it’s not really a sexy topic to talk about. It’s not fun. And sometimes there are layers of shame with money and layers of like, yeah, not a lot of discernment. So like, let’s just like cut through that and like, Let’s lean into some tangible steps. Create a business owner, specifically start implementing profit first. So you said you had more to share about? Yes,

Kelly Mathis

yep. So I’ll bring it down a little bit and just go through a couple steps. And then I’ll then I’ll kind of talk about a little bit more for that. So we’ll start with this. So step one, like I mentioned earlier, is Go grab the book Profit First and read it, it’ll really give you a good handle on what the method is and just walk you through the entire process. Step two, you want to run your instant assessment on your business. So in the book, there is an assessment that you’ll want to do to determine the health of your business as it currently stands, it’ll essentially show you where your money is going. And it can be pretty eye opening. When I did the assessment, when I first read the book, it really showed me that I was spending way too much money on expenses. I kind of knew that. But during that assessment, it just, it was just right there. So it showed that I was spending too much on expenses. And not enough, I’m paying myself or I had like zero profit. So it really caused me to sit down and figure out like what expenses were really unnecessary in my business, and then see what I could cut out. And then I went ahead and I cut all those expenses. So that was step two. Step three, is you want to set up your bank accounts. So you want to set up your bank accounts at two different banks. So the first bank, you’ll want to set up the five accounts that I kind of mentioned earlier, to be your income account, your profit account, your tax account, your owner’s compensation account, and then your operating expense account. I personally use my own local Hometown Bank for these accounts. But you can utilize the one you’re currently at. Or you can do some research for other banks in your areas if you’re kind of wanting to switch. So I always recommend just doing a little bit of research on that. And then the reason Mike has you set up two other accounts at a second bank for just profit and taxes is because we really want you to get this money essentially out of sight, out of mind, you don’t want to have that temptation to utilize it, if it’s just sitting there and where you can easily access it. I know that’s like my issue. Sometimes I see that money. And then I’m like, oh, I want to use it to buy like this new camera. But by putting it in the second bake, it just keeps it out of my out of sight out of mind. And I you know, then I don’t use it. So step four, is to determine what your target allocation percentages are for your taps, ta PS, like I said, the way this system works is all the income all the revenue that you receive from all avenues will go into your income account. So you want to make sure you have everything set up to be deposited into that one account, then we’re going to send all that money out to these different accounts that represent the different parts of your business. So like I mentioned, and be ciphered out to your operating expenses, your taxes, your profit, and then to pay yourself. And so we’re going to do that based off of a certain percentage. So for me, my target allocation percentage for profit is 5%. Taxes I have set at 15%. Owners compensation, which I pay myself from is 50%. And then operating is 30%, which is what I run my business on in the book, there is actually a page that has what these target allocation percentages should be. It’s just a recommended recommendation chart, that really gives you a good starting point for your business. So I’m not like just pulling these numbers out of thin air, I actually use this, this chart in the book to pull my numbers from. So obviously, you don’t have to do exactly what is listed as like a target allocation. But as every business is different industries are different in a lot of variables, you can definitely switch your target allocation percentages up, but it’s a really, really good starting point. Okay, step five, is to determine what your current allocation percentages are, or caps, CIPS. So the target allocation, what I just talked about is where you’re going where you want to go. And that caps is where you are at now. So if you’re running a business, and you’re currently not setting anything aside for profit, and then all of a sudden, if I say hey, you need to start setting aside 10% for profit, it’s just really not realistic to do if you’re not doing it already. So what we want to do is just determine what our current setup is, where can you begin. So you can start by just setting aside 1% 2%, even 3% for profit, and then just slowly work your way up to what that target should be. So you’ll determine these numbers after doing that instant assessment like we had discussed earlier. And then once you have your bank account set up and you know what those percentages are, you’re ready to basically implement the system.

Dolly DeLong

Entrepreneurship is fun, at least I think so. But most entrepreneurs struggle in one very important area in their business finances. Did you know you can create systems around your money to systems in finance can allow you to keep track of your finances, plan for tax season, monitor expenses and prioritize your money so that you’re always turning a profit. And it doesn’t have to be mind numbing. As a creative business owner, you need to understand the numbers behind your business. So let’s make that happen. For just $27 you can grab my bookkeeping template for creatives. This easy to use automated spreadsheet will help you track your expenses, guide you through the spreadsheet with video trainings, and dig into basic data that will influence the numbers of your business. So grab the bookkeeping template for creatives in the show notes of today’s episode, and use the code podcast all one word for 24 sent off. I know for those of you who are listening, a lot of creative business owners listen to this. And you might be like, Oh my gosh, she lost me. So I do want to say like, not only like if you’re looking for a way to like implement this, I know that Kelly has a free resource that she’s going to share with at the end of the show. But also, I will be sharing Kelly’s information in the show notes so that you can contact her directly. She does one on one, coaching calls about profit first, or creative business owners. So there are ways to overcome your fears. If you are glazing over right now.

Kelly Mathis

Can I walk you through kind of what I do with like daily, like how I do daily with this, and then bi weekly and that type of thing, please. So basically now once you have like everything kind of set up, you’re probably wondering, like, how the heck do I use it. So this is what I do daily, any revenue that I receive from all sources gets dumped into income account, like I had mentioned. So for example, in my business, I earn revenue from weddings and senior photography, through print and album sales. I also have an online shop, and coaching. So those are all the areas where I make money and all that revenue gets dumped into my income account, and it just sits there. The second thing I do on a daily basis is then I look at my operating expense account, to make decisions on what I can and can’t afford as a business owner. So whenever I’m looking at a new camera, or if I need to purchase film, a new software or plane tickets, basically anything I need to run my business, I don’t care at all what is in my income account, I’m just looking at what’s in my operating expense account to see if there’s something I can afford. And then I have to decide if it makes good business sense to make that purchase. So that’s kind of what I do on the daily and then bi weekly. So let’s say I received like $10,000 from various revenue sources the past couple weeks, that money will just sit there till it comes to like this bi weekly routine. So for me, I am the 10th and the 25th of each month, or you could choose to do every two weeks just kind of whatever works best for you. But for me on the 25th of each month, I complete these steps. So all the income goes into the income account and sits there. Like I said, I then transfer money from my income account to the other accounts based on my current allocation percentage that I have set up, I then pay myself as the owner. And then if I had any, like contractors or employees and pay them at that time as well. And then I pay bills do between now and then the next two weeks. So I actually created my own Google spreadsheet. And I think I shared this with you Dolly. But the spreadsheet, it actually has my allocation percentages listed. And all I had to do is put whatever amount I have in my income account. So like I said, $10,000, I put $10,000 in there, and it would tell me exactly how much money I need to transfer to each account based off of my allocation, my percentages that I have set up. And it just takes the guesswork out of it. That’s really really nice. It makes it super easy. I’ve kind of find like, that’s like the fun part. And then lastly, my quarterly routine. So the only thing that is different from the bi weekly routine. And the quarterly routine is we just add on a couple more steps. So every quarter, I’ll complete the bi weekly routine first, like I just walked through. And I’ll do that on the same day that I do these steps. But then the next step a couple steps is I will take 50% of whatever is in my profit account, and I pay myself a profit distribution. So if there’s $10,000 in there, I pay myself $5,000 as a profit distribution, and this money is supposed to be spent on you. It’s not sales people back into business. So you could use it to go on a trip to go to a nice dinner, buy a new purse, buy some new shoes, like whatever you want, it should be spent on you. And essentially, it’s just a bonus for being the owner of the business, which I absolutely love. Elvin pay my quarterly taxes out of My Tax Account. And then I’ll review my current allocation percentages and my target allocation percentages. And I’ll make changes to my current allocations to make it closer to where I want to get. Like I said, if you’re just starting with like 1% of profit, if you want to scoot it up to like four or 5% or whatever you can do just to get it closer to where you should be. And then the other 50% that’s left in that profit account, it’ll just stay there and it’ll grow. Basically, it acts as your emergency fund inside your business. So ideally, you want it to get to about three to six months of expenses, and then you’ll just leave it in there unless something happens like a pandemic or you know, you can’t work or something and you can just draw from it to kind of help pay your wages expenses and just kind of keep your business up afloat. So yeah, that’s just kind of my daily bi weekly and quarterly routine. Hopefully that makes a little bit more sense and kind of how to implement it into your business.

Dolly DeLong

I love that and I wanted to share with everyone that Kelly worked out a system for me like to where it’s a not a bi weekly routine for me to pay myself because I like I’m kind of a weirdo and I have been programmed because of my years at working for another person being paid monthly, so I was used to getting paid monthly Going into my business full time. So we set up a system for me to where I go through this checklist at the end of every month. And it’s still, you can totally do that, too. Yeah. And that has been wonderful for me. And so I always look forward to the, either the 30th, or the 31st, depending upon when the month ends, because I’m like, Oh, it’s my profit first day. And so I like, have all set up. And I’ve been tracking the numbers, because I have my own spreadsheet that I use. And then I combined it with the Profit First method. And, and I even like throughout the month, they’ll be like, yes, what, Kai, I’m paying us this much. And he bite now he’s like, it’s old. Like, he’s like, okay, I get it. Like your pay goes like, but yeah, you’d be like, wow, like, that’s a lot of money. And so it’s still so exciting. Because for years, Kelly years, I never paid myself. And I’m just like, how, why did I do that to myself,

Kelly Mathis

That’s just insane to me, I just, I can’t believe that you I would have never known. Like, you’re paying yourself now. And that’s what’s important.

Dolly DeLong

So it feels great. It feels amazing and great. And I’m like, wow, like this, I feel more legit now. But I do want to share with people like you don’t have to go like by the rulebook, the first method, like if you just want to pay yourself once a month? Or do it bi weekly, like Kelly was saying, you can find a way make it work for like when you get paid? Yes. Awesome. Well, Kelly, this is a lot of great information. And I know I’m gonna recommend somebody to listen to this twice, three times. Me too. But most importantly, but how can somebody connect with you, and follow you work with you, and even buy some of the resources from your shop, because I know that you are a lot of financial resources for creative business owners. Yes.

Kelly Mathis

So I’m actually gonna have a freebie for your audience if they want it. And actually, I have a short training video that I’m gonna have for you that you can give to them. But it’s basically how to pay yourself using the Profit First method. So I’m going to go over a lot of what we kind of talked about, but kind of go a little bit deeper with certain things. And it also kind of help you determine like what to pay yourself as a creative business owner. So I’ll get that over to you. But I can be found on Instagram at the handle at Kelly Grace photo underscore, or on Facebook at Kelly Grace photo. And then I also offer personal finance or business finance coaching, as well as one day Profit First intensive so if you want me to kind of walk you through how to set it up for your personal business, I would love to do that. If interested you can send me an email at Hello at Kelly Grace photo comm or you can visit my website at WWW dot Kelly Grace photo.com and click on education. I also have a shop on there too. So it’d be the same thing, just slash shop. And I have a ton of different resources on there to help you with your finances or with your business and that type of thing. So yes, I would love to work with any of us. If you reach out, I would absolutely love it.

Dolly DeLong

Yeah, I was gonna say like, I know that you might be listening in. Okay, Dolly, you’re telling us to watch where you spend your money and like how you profit. But I would encourage you if you have any extra money to spend, and invest in your business, invest in getting to your finances first to like good foundations. So please reach out to Kelly, I’m not getting any sort of affiliate like, she’s not paying me to promote her. She’s incredible. She’s a real deal. And she will really walk you through everything that you need to know. And like even if you have student loan debt, or if you have any debt, she’ll walk you through how to handle that, in addition to paying yourself as a creative business owner. So don’t let the fear of where to start and the fear of Well, I don’t I don’t know how to start. Like I just don’t know where to start. So please just like reach out to Kelly just me giving you permission to lay a good foundation for your finances because it’s really really important. Yes, yes, I

Kelly Mathis

would love to work with you. Please reach out. Thank you Dolly. You’re so sweet.

Dolly DeLong

You’re amazing. And like I said my husband and I are big fans of you and he’s so grateful for you!

Kelly Mathis

well I would love to meet him someday.

Dolly DeLong

To get together making him sound like a really excitable person he’s not he’s very like mellow and very. I’m excited. But I just want to say again and everybody please give Kelly a follow and reach out to her and go in the show notes and access all the resources that she has for you. And I will talk to you all next week with more systems and workflow magic. And again, give Kelly a follow up and let me know how this episode was helpful for you. So thanks again for following and I will talk to you all later. Bye. Thank you so much for listening to the systems and workflow magic podcast. You can find full show notes from today’s episode at dolly DeLong photography.com forward slash podcast. If you’re loving the podcast, I’d be so honored if you’d subscribe and leave a review on your favorite podcast player. Be sure to screenshot this episode, share it to your stories and tag me at dolly DeLong education over on Instagram. Until next time, go make some strategic workflow magic

Transcribed by https://otter.ai

Leave a Reply

Finally get those dreamy & classic family photos you desire & want!

[…] Episode 20 (I Interview My Profit First Coach) […]